Say hello to Portabl Verify, Portabl Accounts, and Portabl Network.

🎉 This is easily our biggest set of announcements ever 🎉

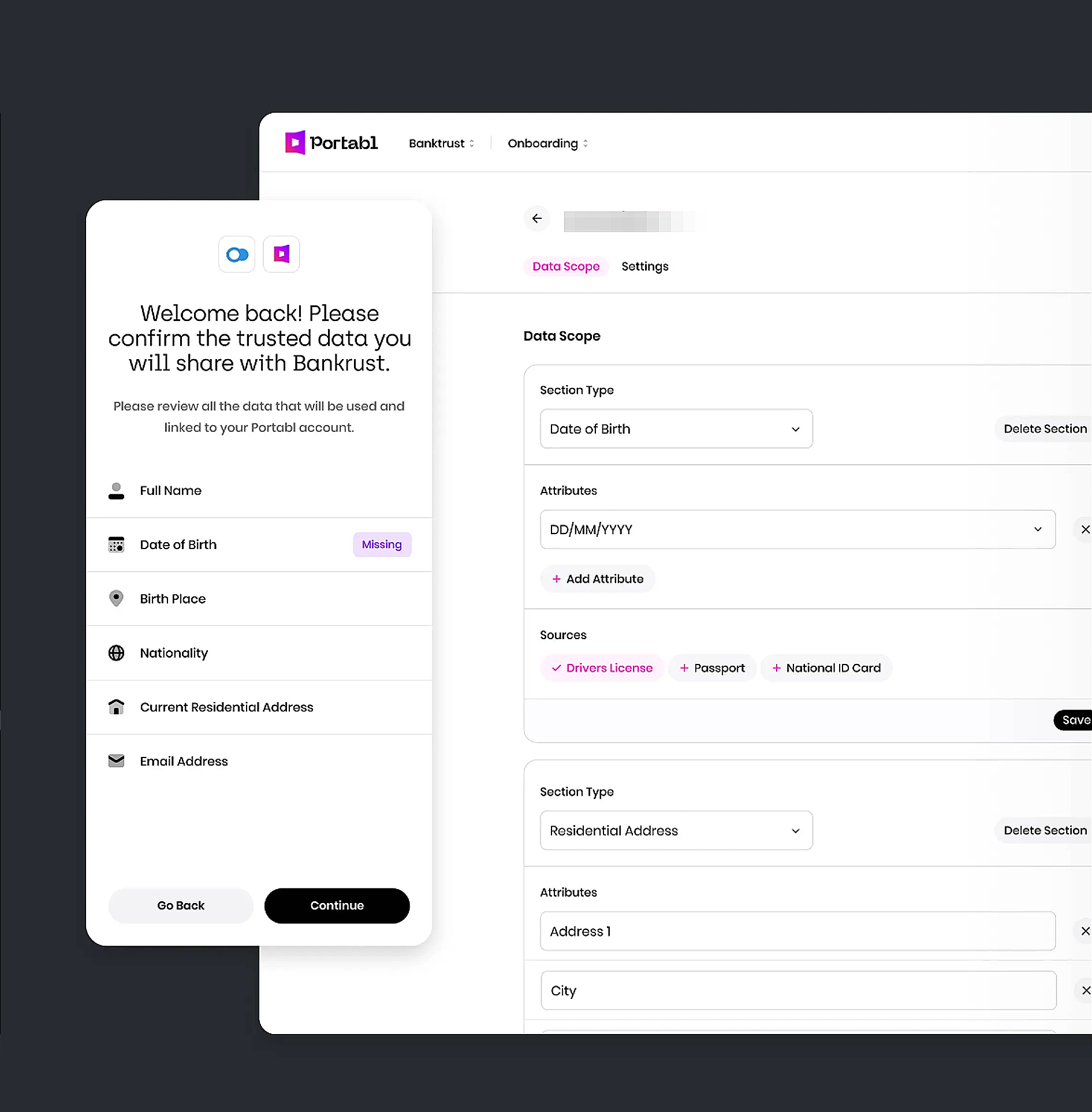

We moved around some of our functionality and reshaped our pricing to make it even easier for infrastructure providers and developers to flexibly tap into our reusable identity platform to build trust networks, powerful and instant KYC with integrated open banking, or integrating our risk and network alerting.

- Portabl Verify: Verify users up and down the assurance scale and analyze risk in seconds. Today we have ID coverage for over 230M IDs in the US & Canada, plus supplementary ID verification in 180 countries and counting. With a powerful set of over 300 risk signals and scoring mechanics covering device, behavior, session, documents, network cross links and duplicates, PEPs, sanctions, and more.

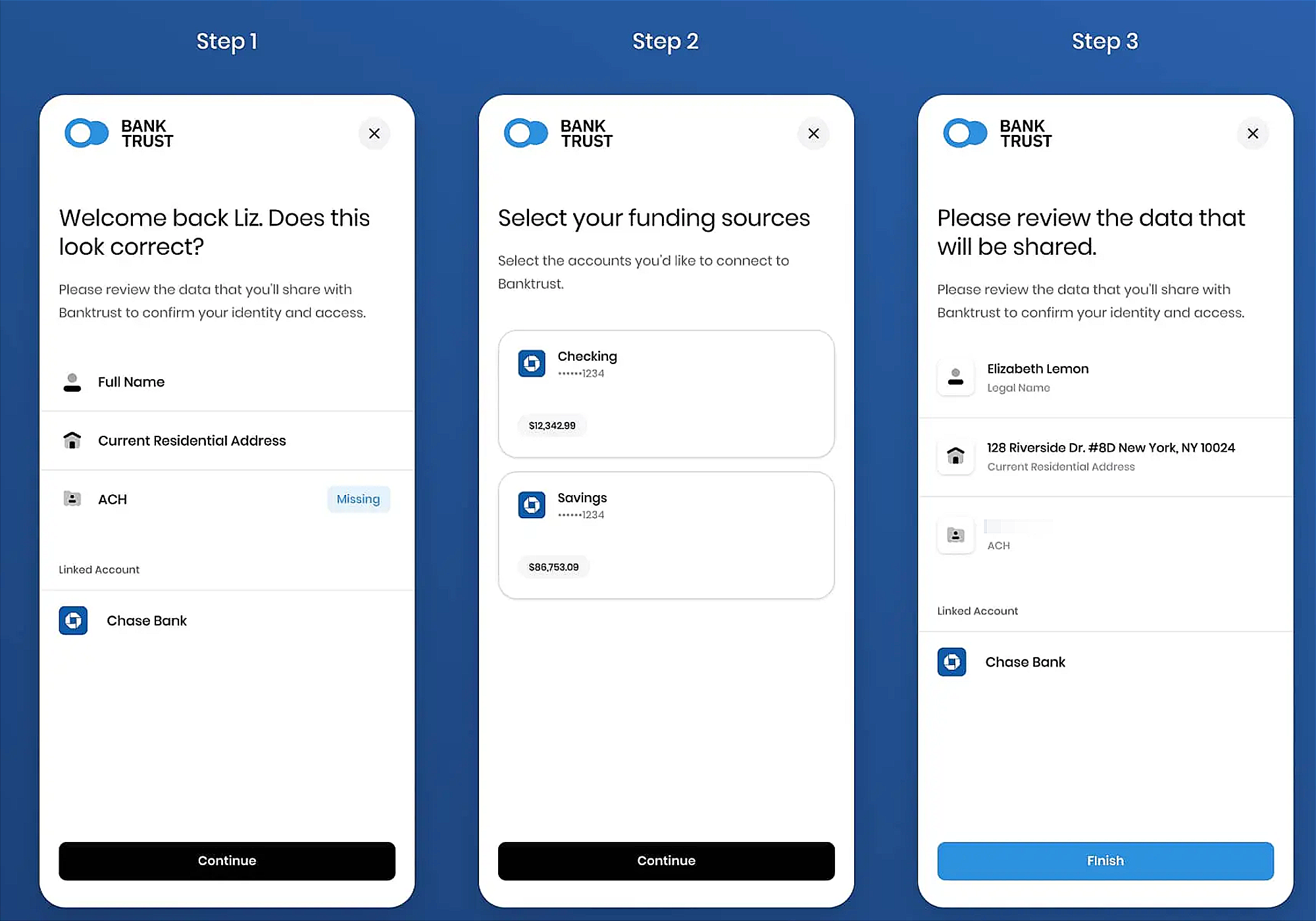

- Portabl Accounts: We’re making open banking connectivity, account linking, and bank-based ID portable. Hook into highly-available tokenized access covering over 95% of US consumer deposit accounts today to cross link accounts to trusted, known users and simplify account validation through biometric ACH binding in place of redirects.

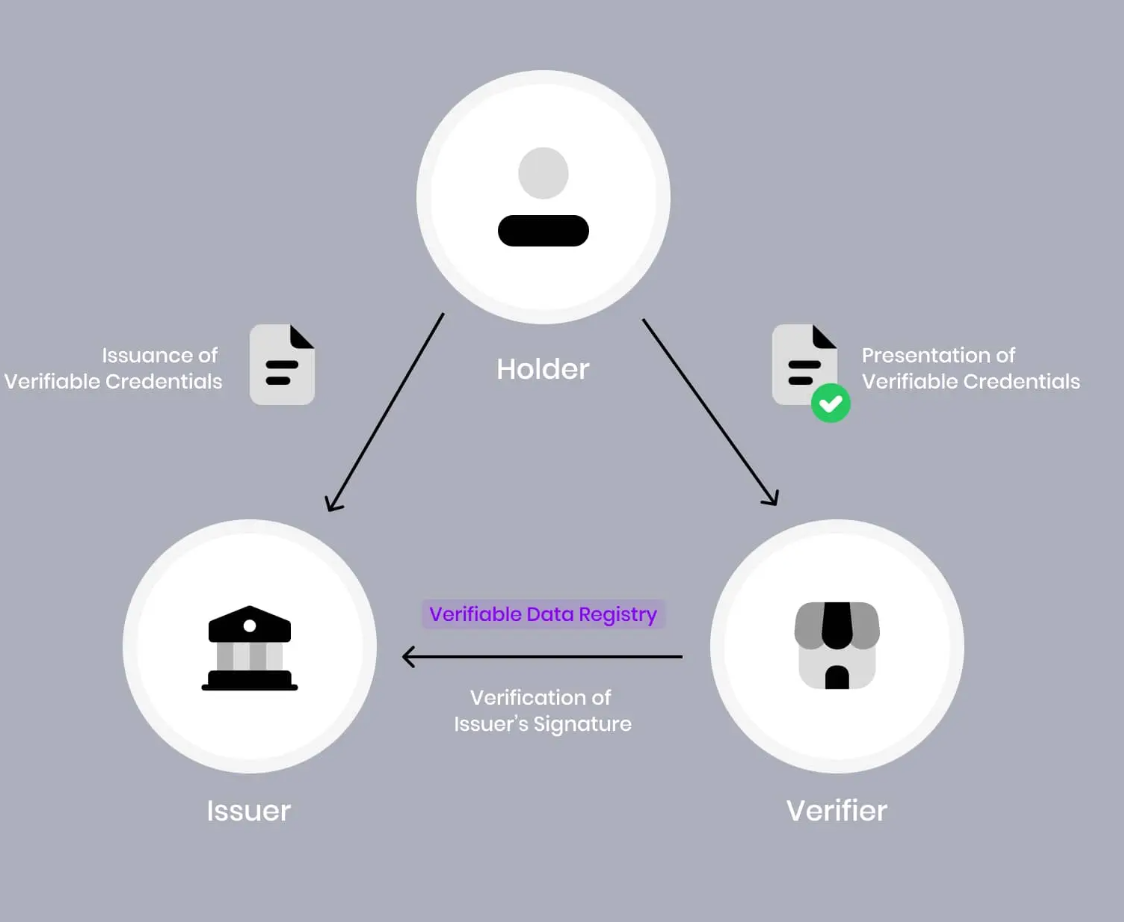

- Portabl Network: Unified rails for building portable identity and fraud alerting into your existing ecosystems—access a positive and negative network in the same integration. The cutting-edge cryptography we use to make it fast, easy, and simple to spot the “real” data owner on our network also powers protections against stolen, synthetic, and unauthorized data use and real-time network alerting.

Collaborate on Portabl Network, starting today

One Bank Secrecy Act (BSA) officer:

“This is like ChexSystems or EWS for fintech in real time"

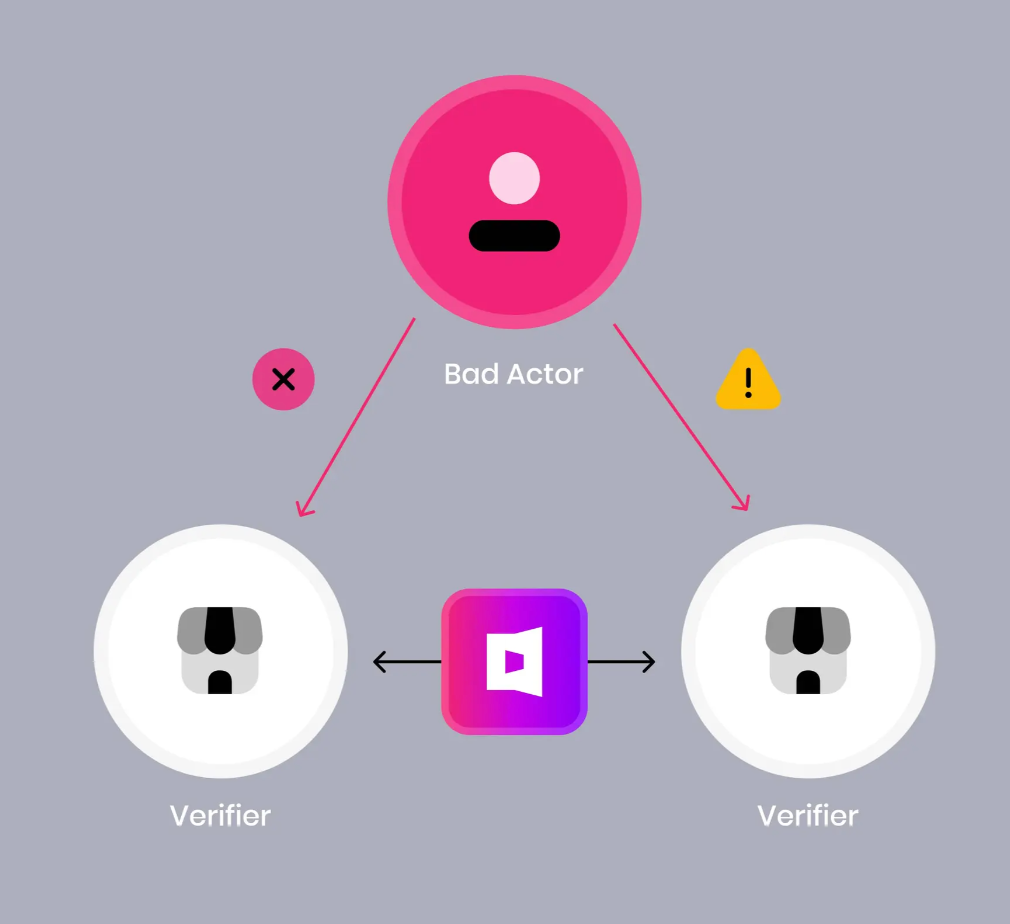

📣 We're running with that observation and opening the beta for our fraud alerting network based on our reusable ID rails. Any business that touches money has valuable fraud data to share with one another — why not do it in a way that also shores up the integrity of the good users?

Interested in joining the network? Reach out at network@getportabl.com

We’re excited by what we have in beta today— the positive/negative network combo approach overcomes the speed and governance challenges of traditional consortium models. We think it represents the future of blocking bad actors at the speed of payments while making it impossible for them to use (or re-use) data that's not rightfully theirs, whether because it is stolen, synthetic, or deepfaked.

Verify: Crosslinked ID coverage for over 230M IDs and counting

One integration covering global IDV, mobile network identity, proof of address, and screening, all atop our reusable ID network for 230M identities and counting.

As of today, businesses building on Portabl can verify their users’ names, addresses, DOB/age, contact details, SSN, device, and more based on flexible combinations of docs, phone, and additional sources. Pair flexible configurations and rulesets with with biometrics and device binding at the point of successful verification to tap into strong deduping and synthetic protections.

Lightweight orchestration, heavy-duty scope, and securely reusable after the initial verification.

Accounts: Reusable open banking — Portable account validation, account linking, and bank ID

You’ll remember that we took part in the Mastercard Start Path Open Banking program some months back. Today, we’re building on our innovations to make open banking connectivity, account linking, and bank-based ID portable.

This update allows us to hook into highly available tokenized access with most of the largest FIs and service providers in the US— over 10,000 institutions and over 95% of US residents today and counting.

Just like we do with our ID linking, we match and bind open banking information to trusted users, biometrics, and devices, protecting the account use over time and providing new types of risk signal across the life of the connection focusing on reputation and integrity.

The impact? Portable ACH and simplified account validation and funding, no more open banking redirect required.

Risk and Fraud

Screening & monitoring

This one is straightforward: we’ve released global access to Sanction, PEP, and watchlist screening with configuration for automated monitoring, all without interrupting our core 2-touch flow. This covers thousands of live sanctions and PEP watchlists including OFAC, UN, and more.

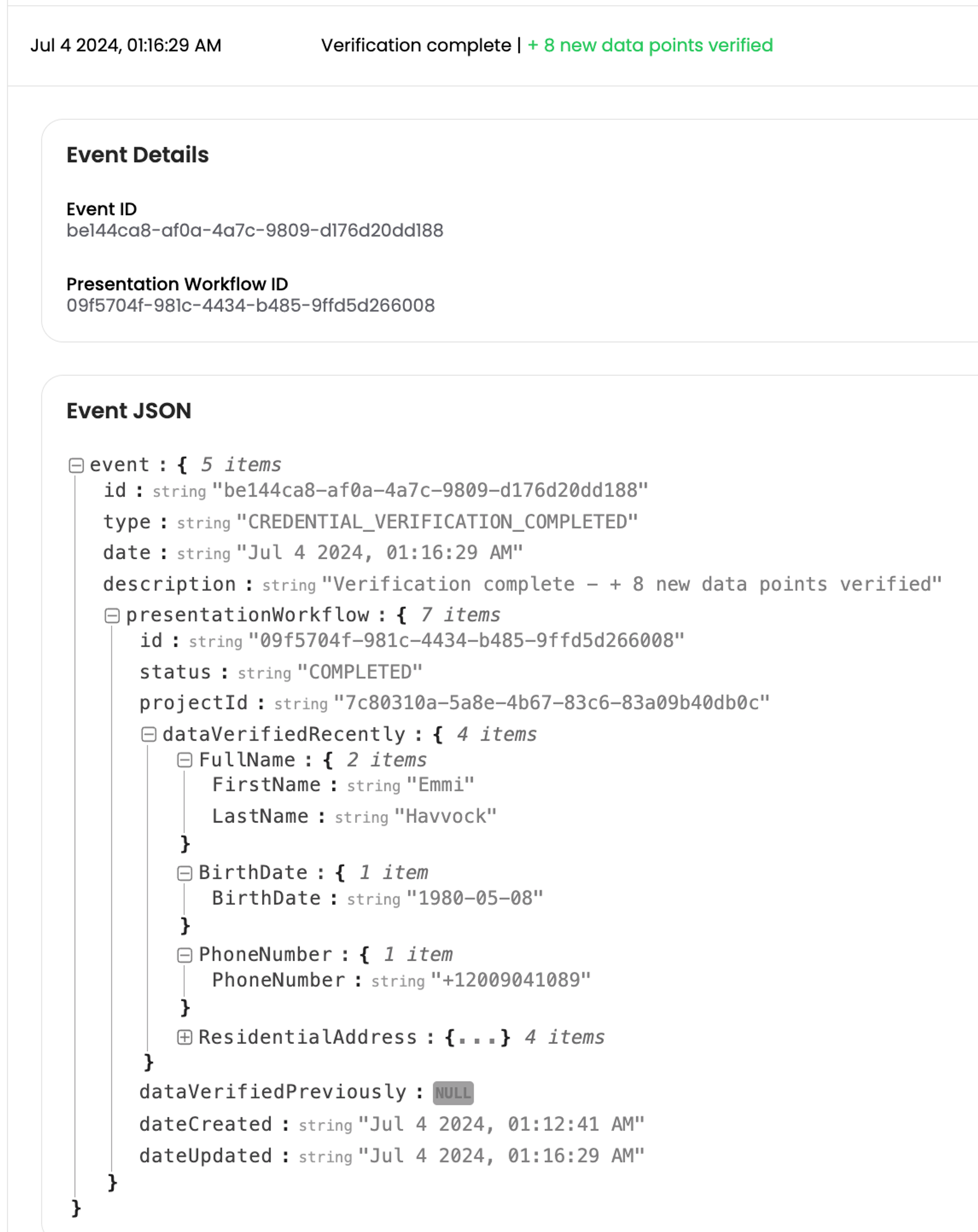

We can tie screening to both net-new verifications as well as verifications based on verifiable credentials. In both cases, screening runs silently in fractions of a second and connects any results with the presented ID information and underlying risk information.

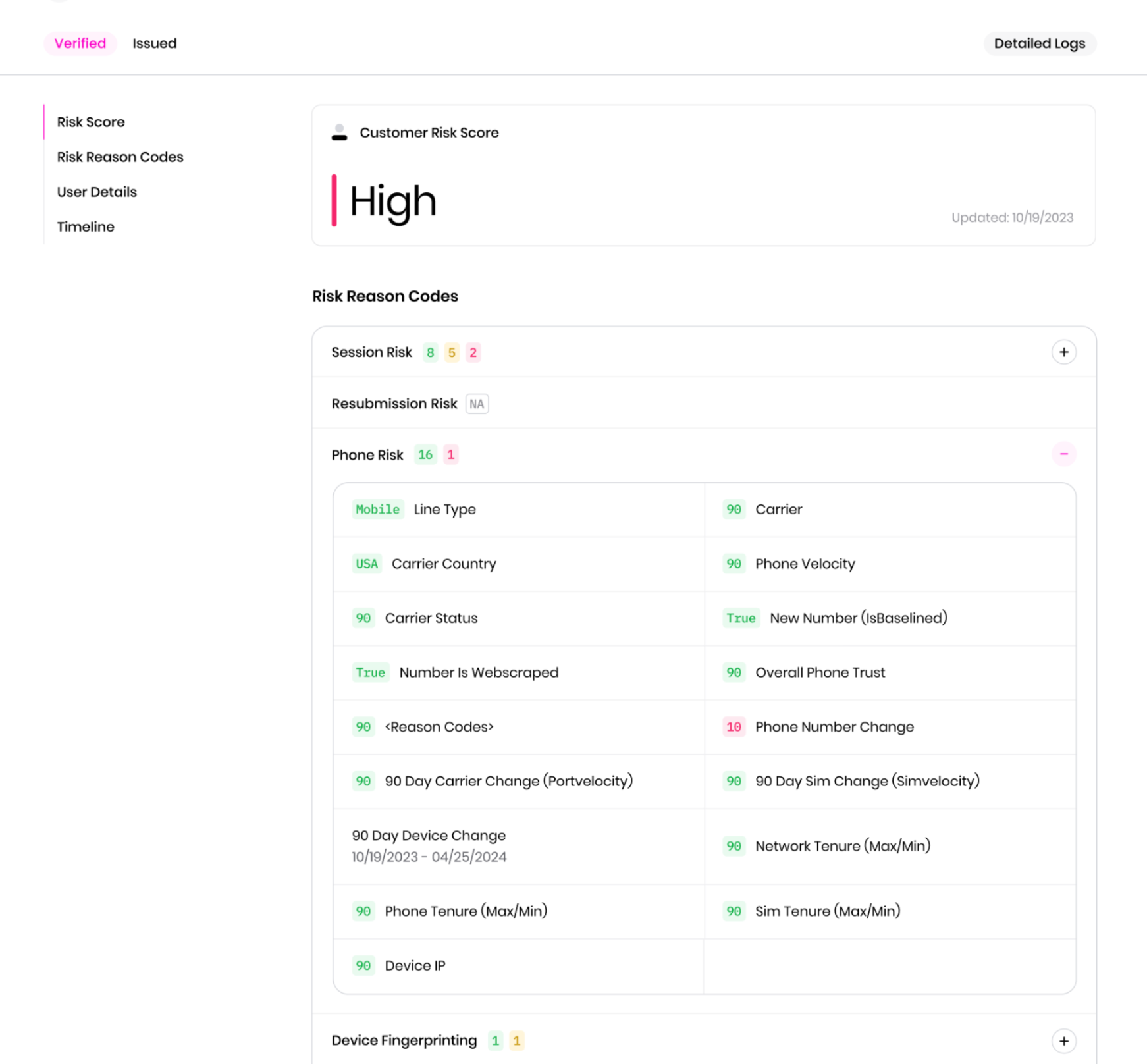

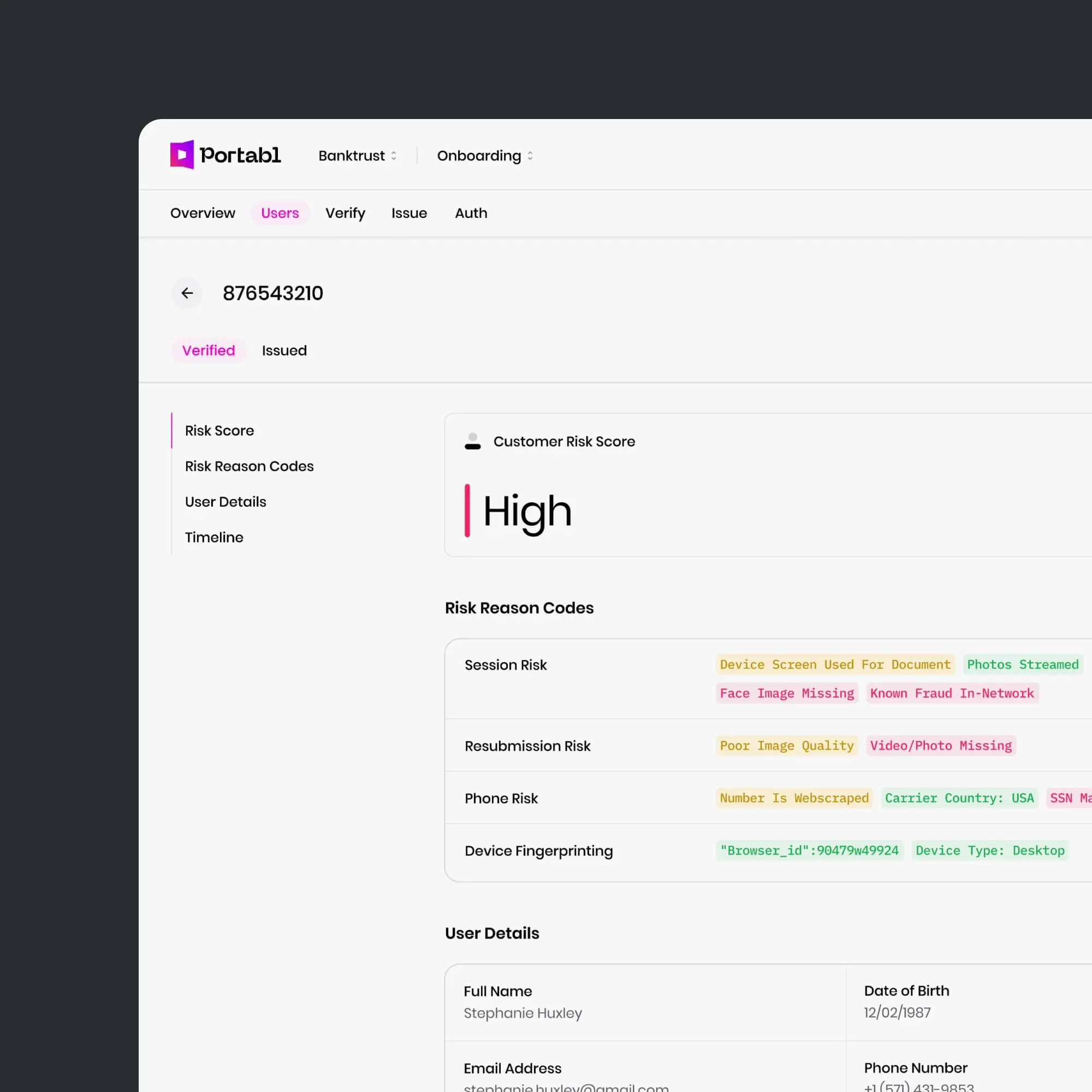

Fraud and risk signals

As of today, businesses building on Portabl can tap into over 300 additional risk signals covering data, documents, sessions, behavior, devices, synthetic flags, and more. We expose the granular risk elements via the console and via API, and have rolled this into a simplified Low/Medium/High risk final adjudication framework make this as drop-in as possible.

Coming soon: custom weights and a new look for our rules control panel.

Advance visibility

We can now send through risk signals even if the applicant abandons the verification session and does not submit data — we give you proactive visibility into risk from the moment they come knocking. This allows you to track and detect

- track incomplete sessions

- monitor for velocity related abuse

- generate allow and disallow lists based on device and session-based signals.

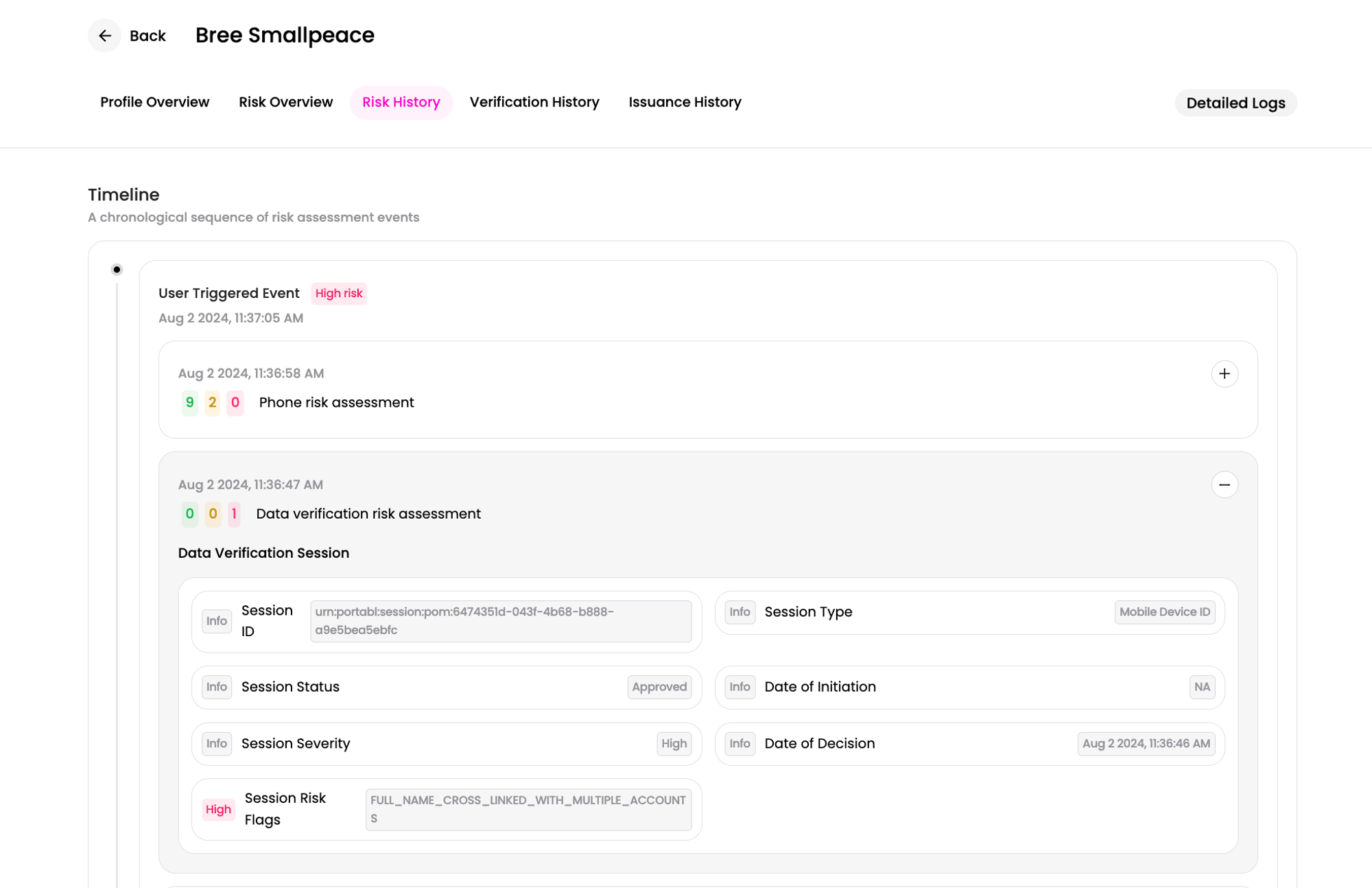

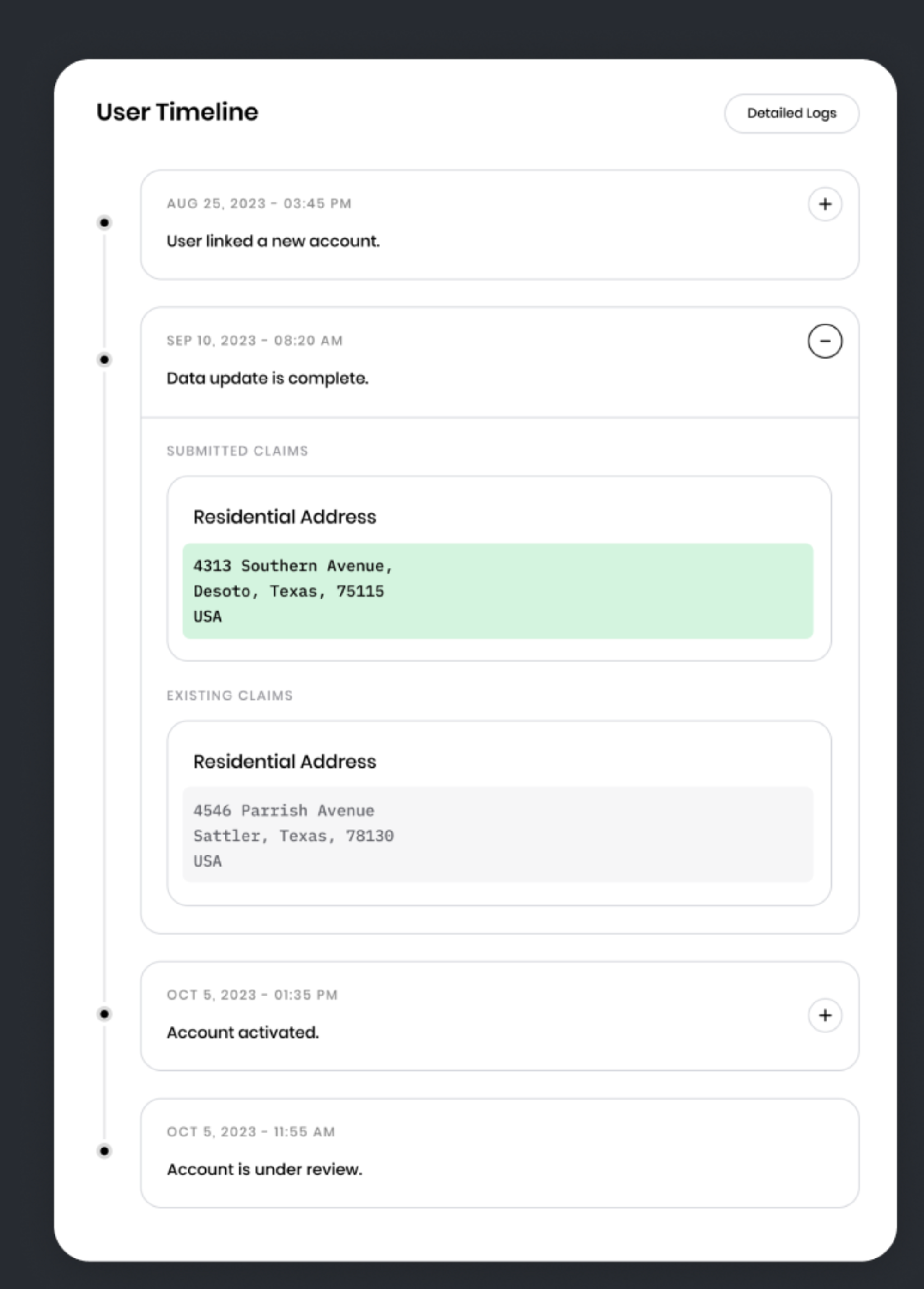

Network cross-linking & change tracking

First-party fraud avoidance needs to be just as proactive as it is reactive.

From today, we have network-wide cross-linking — we can detect mismatched or misused information in the network and can flag those discontinuities at downstream verification events while still being on the right side of data minimization.

We track changes to internal and network risk over time and feed that into the profile feel in response to updated signals based on your configuration. Risk is dynamic, and so should your ability to keep an eye on it. Ongoing monitoring isn’t just in the domain of screening anymore — it’s everything.

This is just the beginning of our next chapter. Watch this space for much more coming soon—additional customization, network risk reporting, open banking flexibility, usability enhancements, and more!