Welcome to the Portabl Resource Center

Portabl is on a mission to simplify financial access by making identity, account, and payment information secure and reusable. Get started here.

The space for feature highlights, insightful reads on the latest identity trends & informative how-to’s

Every financial identity blog starts somewhere. Let's kick things off with a short introduction about ourselves and a quick breakdown of what to expect from our resource hub.

You might already be familiar with Portabl (if not, click here). If you're looking for high-quality content about the financial identity world, we're glad you're here.

Our goal is to help you, your business and your users feel more secure in verifying, managing and protecting their most sensitive data from the very start. So let’s dive in.

Key Highlights:

- What is Portabl?

- What are we solving?

- Who's building it?

- What content to expect

What's Portabl & what are we solving?

Portabl is on a mission to simplify financial access by making all types of identity information secure and reusable throughout the open banking landscape.

Problem

The status quo bums us out. Right now, our financial identity and reputation is stuck in our banks, apps and aggregators—mostly fragmented, out of sync and vulnerable.

As consumers, we can’t take our data with us very easily, let alone control how it is used and shared.

New app? Time to submit and re-verify the same information all over again. 😖 New app? Another account to maintain. 😬

Businesses are stuck proving our identities from scratch more than ever. KYC & onboarding processes are high-friction, prone to abuse and fraud and leave businesses under-equipped for the future of consumer-permissioned data.

The 50% onboarding attrition rate is just one of many metrics all pointing to the fact that identity—from origination through account close—is broken.

Since consumers are asking for more ownership and better accessibility to their own data, we thought, 'Let's give it to them, but the right way.'

Solution

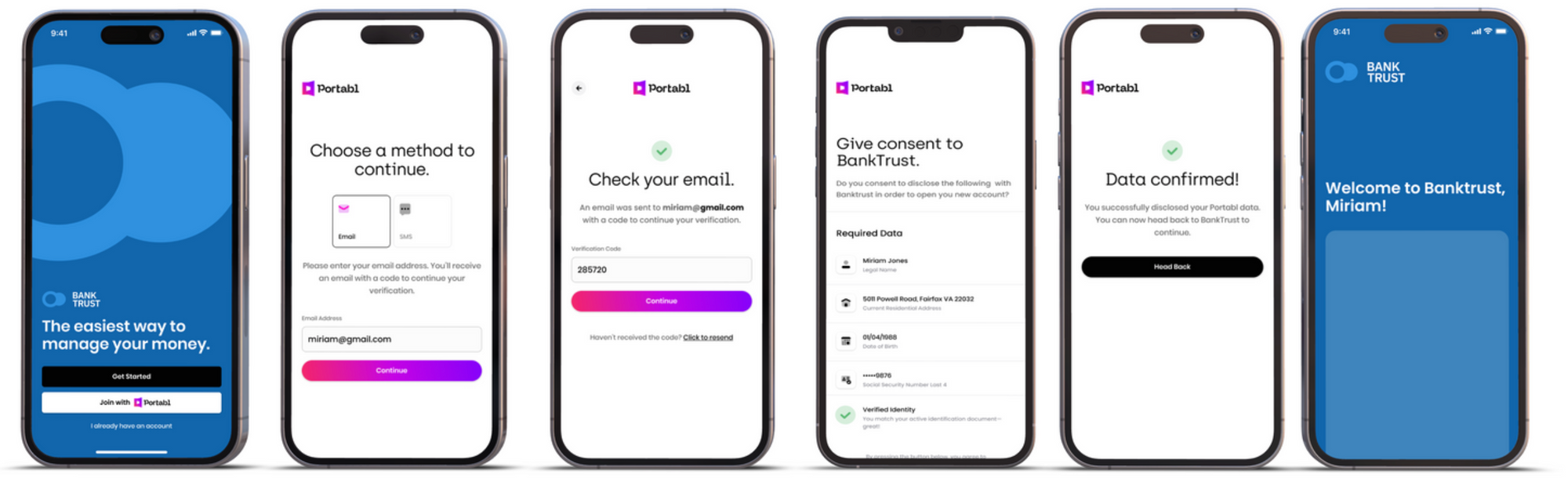

Based on next-generation decentralized identity standards, Portabl fills the gap in open banking by allowing consumers to control and share pre-verified data about their identities, accounts and payment methods in just a few clicks without having to re-enter, re-submit or re-connect their information.

Two clicks. Zero Passwords. Limitless flexibility.

That's what we're all about.

Simply put: single-sign-on for financial services.

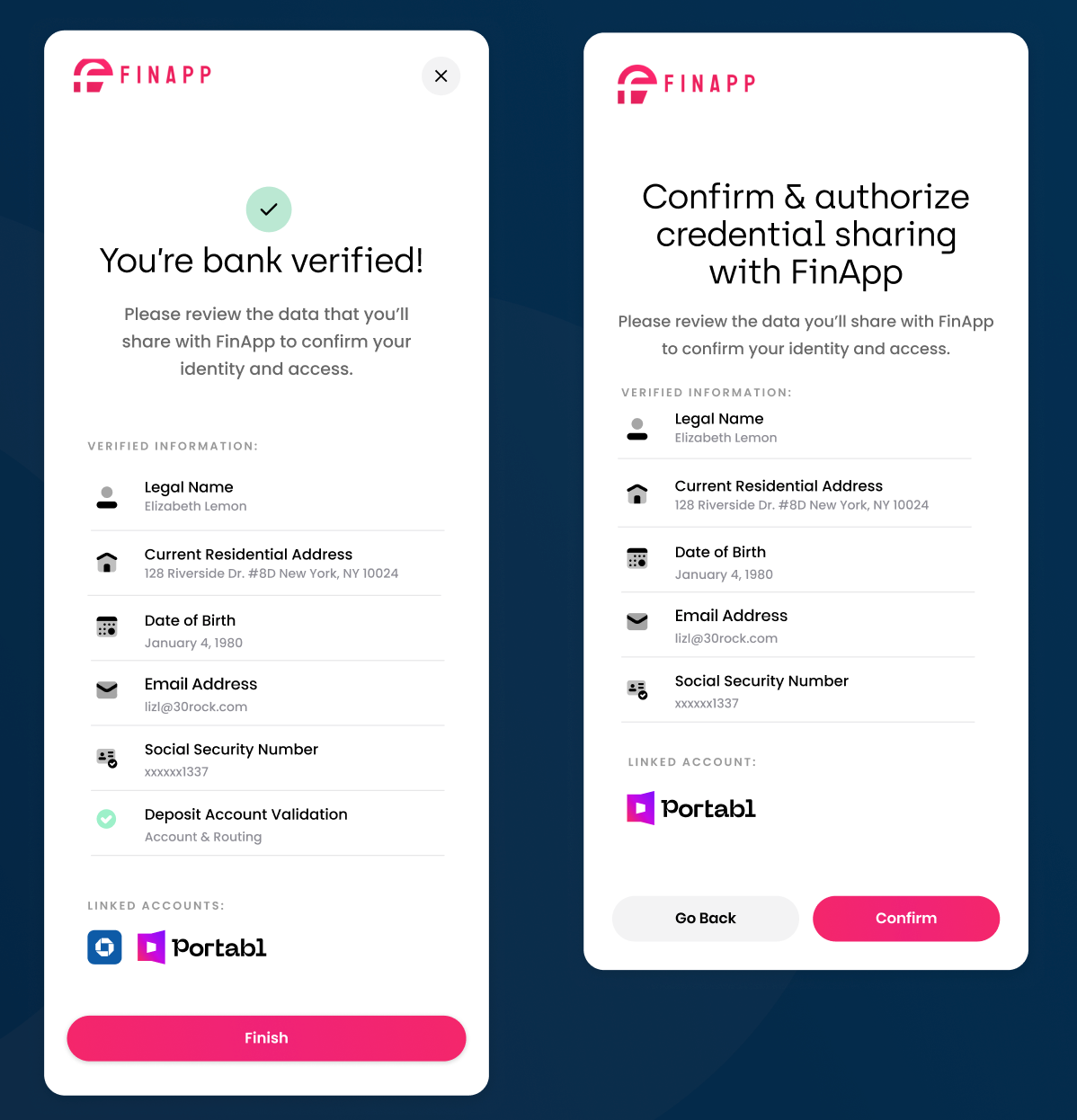

- From the consumer perspective, the Portabl digital passport is where users can fully control their data across multiple channels and manage account connections within seconds, with ease.

- From the provider perspective, by bundling KYC, bank-verified ID and account verification, we enable banks, fintechs and financial infrastructure providers to build simpler account creation, sign-in and data management experiences within a single reusable identity platform.

Until now, apps and providers could not verify and authenticate customers by leveraging providers those users already trust. With Portabl, you can tap into our version of 'remember me' that works across providers and networks for tens of cents, not ones of dollars, per verification.

The effect? Smoother signups, less attrition, lower fraud rates, and higher NPS/TLV with a lower TCO.

Who's building it?

Portabl was founded by Nate Soffio and Alex Yenkalov in 2021. Together, they bring over 20 years of experience at the intersection of KYC/AML, open banking and decentralized identity to solving for reusable ID based on the newest emerging technical standards

Our small team is funded and supported by some of the best and brightest who believe in our vision.

Content on deck…

Our blog is the resource center you can rely on for general and more niche financial identity topics.

Here are a few examples of what you can expect on here in the coming weeks:

- How to build trust with new and existing users while blocking ATOs through reciprocal authentication

- A look inside verifiable credentials and what we learned from shipping containers in the 1960s

- How to mix and match identity credentials, KYC data, and bank validations to balance identity assurance with simplicity

- Tips on configuring custom data requests and verifying multiple credentials in a single user flow

And more!

If you have any questions or want to see specific content, drop us a line at hello@getportabl.com